How Do I Apply For Homestead Exemption In Minnesota . Individual taxpayer identification numbers now qualify. — how do i qualify? Before you get started, here is a list of information you will be asked to include in your application:. 31 to get benefits on next year's taxes. To apply for the residential homestead classification, you must: currently, we only accept the standard real property homestead application electronically. having a homestead classification may qualify your property for a homestead market value exclusion or one of the. be a minnesota resident. You must be an owner of the. To qualify for a homestead, you must meet the following criteria: — apply for homestead status with hennepin county by dec. homestead status can save you money on your property taxes. the exclusion reduces the taxable market value of qualifying homestead properties. By decreasing the taxable market value, net property taxes are.

from www.formsbank.com

To apply for the residential homestead classification, you must: 31 to get benefits on next year's taxes. — apply for homestead status with hennepin county by dec. be a minnesota resident. — how do i qualify? To qualify for a homestead, you must meet the following criteria: having a homestead classification may qualify your property for a homestead market value exclusion or one of the. By decreasing the taxable market value, net property taxes are. homestead status can save you money on your property taxes. You must be an owner of the.

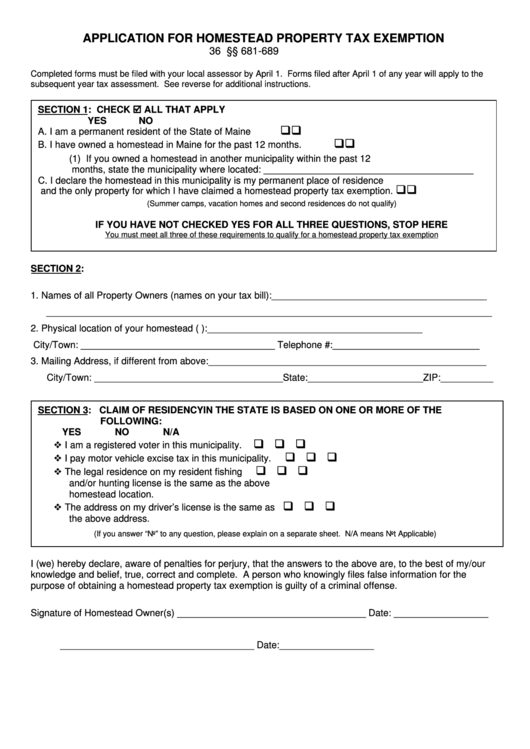

Application For Homestead Property Tax Exemption Form printable pdf download

How Do I Apply For Homestead Exemption In Minnesota be a minnesota resident. To qualify for a homestead, you must meet the following criteria: homestead status can save you money on your property taxes. To apply for the residential homestead classification, you must: — how do i qualify? the exclusion reduces the taxable market value of qualifying homestead properties. having a homestead classification may qualify your property for a homestead market value exclusion or one of the. — apply for homestead status with hennepin county by dec. be a minnesota resident. Before you get started, here is a list of information you will be asked to include in your application:. 31 to get benefits on next year's taxes. Individual taxpayer identification numbers now qualify. By decreasing the taxable market value, net property taxes are. You must be an owner of the. currently, we only accept the standard real property homestead application electronically.

From www.youtube.com

How To File Homestead Exemption 🏠 Collin County YouTube How Do I Apply For Homestead Exemption In Minnesota To apply for the residential homestead classification, you must: 31 to get benefits on next year's taxes. You must be an owner of the. By decreasing the taxable market value, net property taxes are. Individual taxpayer identification numbers now qualify. Before you get started, here is a list of information you will be asked to include in your application:. . How Do I Apply For Homestead Exemption In Minnesota.

From www.youtube.com

How to fill out Homestead Exemption Application? YouTube How Do I Apply For Homestead Exemption In Minnesota To qualify for a homestead, you must meet the following criteria: — how do i qualify? 31 to get benefits on next year's taxes. be a minnesota resident. homestead status can save you money on your property taxes. You must be an owner of the. having a homestead classification may qualify your property for a homestead. How Do I Apply For Homestead Exemption In Minnesota.

From www.uslegalforms.com

Minnesota Homestead How Do I Apply For Homestead Exemption In Minnesota be a minnesota resident. To qualify for a homestead, you must meet the following criteria: currently, we only accept the standard real property homestead application electronically. By decreasing the taxable market value, net property taxes are. Before you get started, here is a list of information you will be asked to include in your application:. homestead status. How Do I Apply For Homestead Exemption In Minnesota.

From walletgenius.com

What Is a Homestead Exemption, and Do You Qualify? WalletGenius How Do I Apply For Homestead Exemption In Minnesota the exclusion reduces the taxable market value of qualifying homestead properties. To qualify for a homestead, you must meet the following criteria: — apply for homestead status with hennepin county by dec. To apply for the residential homestead classification, you must: Individual taxpayer identification numbers now qualify. You must be an owner of the. be a minnesota. How Do I Apply For Homestead Exemption In Minnesota.

From www.youtube.com

Homestead Exemption Application YouTube How Do I Apply For Homestead Exemption In Minnesota — apply for homestead status with hennepin county by dec. — how do i qualify? To qualify for a homestead, you must meet the following criteria: Before you get started, here is a list of information you will be asked to include in your application:. You must be an owner of the. currently, we only accept the. How Do I Apply For Homestead Exemption In Minnesota.

From www.signnow.com

Waiver Homestead Exemption Form Fill Out and Sign Printable PDF Template signNow How Do I Apply For Homestead Exemption In Minnesota Before you get started, here is a list of information you will be asked to include in your application:. having a homestead classification may qualify your property for a homestead market value exclusion or one of the. currently, we only accept the standard real property homestead application electronically. Individual taxpayer identification numbers now qualify. be a minnesota. How Do I Apply For Homestead Exemption In Minnesota.

From dxopymzkj.blob.core.windows.net

Where Do I Apply For Homestead Exemption In Pinellas County at Estrella Sussman blog How Do I Apply For Homestead Exemption In Minnesota — apply for homestead status with hennepin county by dec. To qualify for a homestead, you must meet the following criteria: To apply for the residential homestead classification, you must: the exclusion reduces the taxable market value of qualifying homestead properties. Individual taxpayer identification numbers now qualify. Before you get started, here is a list of information you. How Do I Apply For Homestead Exemption In Minnesota.

From www.slideshare.net

Homestead exemption form How Do I Apply For Homestead Exemption In Minnesota To apply for the residential homestead classification, you must: Individual taxpayer identification numbers now qualify. Before you get started, here is a list of information you will be asked to include in your application:. 31 to get benefits on next year's taxes. the exclusion reduces the taxable market value of qualifying homestead properties. having a homestead classification may. How Do I Apply For Homestead Exemption In Minnesota.

From www.taylorrealtygroup.com

How to apply for a Homestead Exemption How Do I Apply For Homestead Exemption In Minnesota 31 to get benefits on next year's taxes. To qualify for a homestead, you must meet the following criteria: Before you get started, here is a list of information you will be asked to include in your application:. You must be an owner of the. — how do i qualify? Individual taxpayer identification numbers now qualify. — apply. How Do I Apply For Homestead Exemption In Minnesota.

From www.formsbank.com

Homestead Exemption Application printable pdf download How Do I Apply For Homestead Exemption In Minnesota 31 to get benefits on next year's taxes. Before you get started, here is a list of information you will be asked to include in your application:. homestead status can save you money on your property taxes. the exclusion reduces the taxable market value of qualifying homestead properties. To apply for the residential homestead classification, you must: . How Do I Apply For Homestead Exemption In Minnesota.

From www.houstonproperties.com

2020 Update Houston Homestead Home Exemptions StepByStep Guide How Do I Apply For Homestead Exemption In Minnesota having a homestead classification may qualify your property for a homestead market value exclusion or one of the. currently, we only accept the standard real property homestead application electronically. To apply for the residential homestead classification, you must: — how do i qualify? the exclusion reduces the taxable market value of qualifying homestead properties. Before you. How Do I Apply For Homestead Exemption In Minnesota.

From study.com

Quiz & Worksheet Homestead Exemptions in MN Real Estate How Do I Apply For Homestead Exemption In Minnesota — apply for homestead status with hennepin county by dec. To apply for the residential homestead classification, you must: By decreasing the taxable market value, net property taxes are. Before you get started, here is a list of information you will be asked to include in your application:. Individual taxpayer identification numbers now qualify. To qualify for a homestead,. How Do I Apply For Homestead Exemption In Minnesota.

From www.formsbank.com

Fillable Application For General Homestead Exemption printable pdf download How Do I Apply For Homestead Exemption In Minnesota 31 to get benefits on next year's taxes. be a minnesota resident. By decreasing the taxable market value, net property taxes are. having a homestead classification may qualify your property for a homestead market value exclusion or one of the. You must be an owner of the. currently, we only accept the standard real property homestead application. How Do I Apply For Homestead Exemption In Minnesota.

From www.formsbank.com

Form 50114 Application For Residential Homestead Exemption printable pdf download How Do I Apply For Homestead Exemption In Minnesota currently, we only accept the standard real property homestead application electronically. 31 to get benefits on next year's taxes. having a homestead classification may qualify your property for a homestead market value exclusion or one of the. Before you get started, here is a list of information you will be asked to include in your application:. You must. How Do I Apply For Homestead Exemption In Minnesota.

From www.pinterest.com

Homestead & Exemptions How to apply, Real estate news, Homeowner How Do I Apply For Homestead Exemption In Minnesota — apply for homestead status with hennepin county by dec. Before you get started, here is a list of information you will be asked to include in your application:. 31 to get benefits on next year's taxes. Individual taxpayer identification numbers now qualify. By decreasing the taxable market value, net property taxes are. be a minnesota resident. . How Do I Apply For Homestead Exemption In Minnesota.

From www.lendingtree.com

What Is a Homestead Exemption and How Does It Work? LendingTree How Do I Apply For Homestead Exemption In Minnesota 31 to get benefits on next year's taxes. Individual taxpayer identification numbers now qualify. To apply for the residential homestead classification, you must: To qualify for a homestead, you must meet the following criteria: — apply for homestead status with hennepin county by dec. currently, we only accept the standard real property homestead application electronically. — how. How Do I Apply For Homestead Exemption In Minnesota.

From madmimi.com

APPLY FOR YOUR HOMESTEAD EXEMPTION How Do I Apply For Homestead Exemption In Minnesota 31 to get benefits on next year's taxes. Individual taxpayer identification numbers now qualify. To apply for the residential homestead classification, you must: homestead status can save you money on your property taxes. By decreasing the taxable market value, net property taxes are. You must be an owner of the. — how do i qualify? To qualify for. How Do I Apply For Homestead Exemption In Minnesota.

From www.har.com

How to Apply for Your Homestead Exemption Plus Q and A How Do I Apply For Homestead Exemption In Minnesota You must be an owner of the. 31 to get benefits on next year's taxes. Individual taxpayer identification numbers now qualify. — how do i qualify? currently, we only accept the standard real property homestead application electronically. To qualify for a homestead, you must meet the following criteria: Before you get started, here is a list of information. How Do I Apply For Homestead Exemption In Minnesota.